How to Use The Dilution Calculator

We are providing a guide on how to use the dilution calculator and fundraising forecasting tool for early stage startups.

Table of Contents

If you are not familiar with the different startup terms and the lingo then please visit our Startup FAQ.

How to Get Started

The first time to open the excel dilution calculator made for early stage startups you will be presented with an introduction page that gives you an overview. Please read through this page and make sure that you agree to the terms of use.

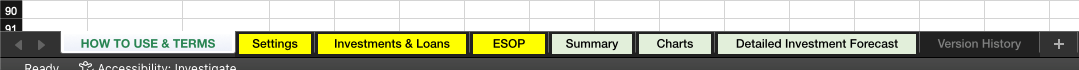

At the bottom of the excel application, you will find 6 other sheets. 3 of them are marked in YELLOW. They will take YOUR inputs that will be used for the calculations in the sheets marked with Light Green.

Settings

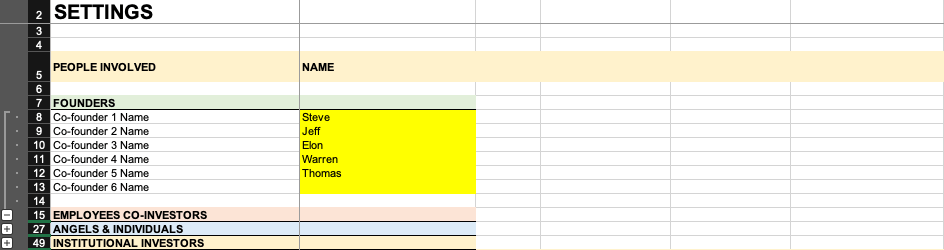

Fonunder And Investor Names

Names of the co-founders, employees who are co-investing, angel investors, and VCs. You can add up to 6 co-founders, 10 employees, 20 angels, and 4 VCs per round. It’s likely more than you need so just keep the rows blanks and hide them. Please notice that you can expand each group by clicking on the + /- on the left side of the application.

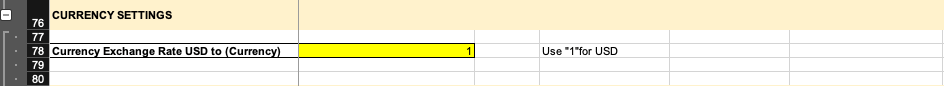

Currency Converter

Here you can convert the currency that you will be using. The sheet is based on USD so if you want to use EUR instead please inters the conversion rate.

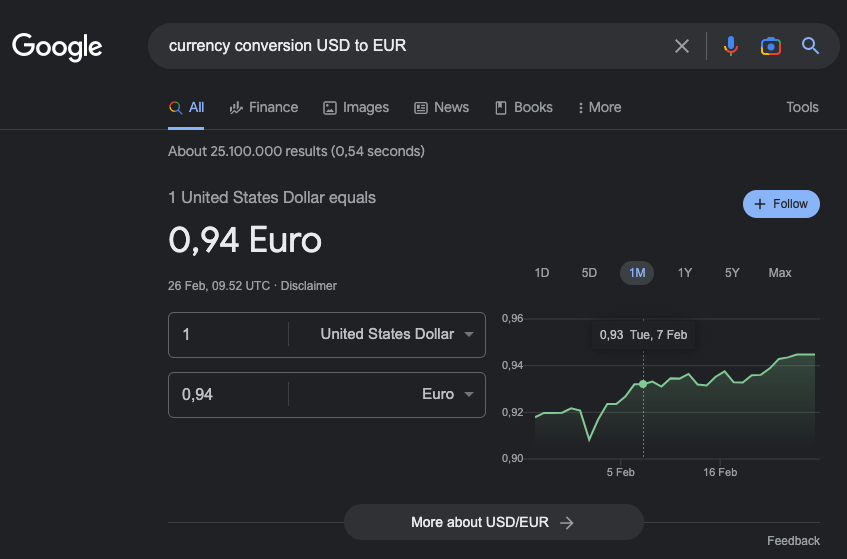

You can find a currency converter on Google by searching for: “currency conversion USD to [currency name]”. In the example below use 0.94 if you want to use EUR as the main currency in the sheet.

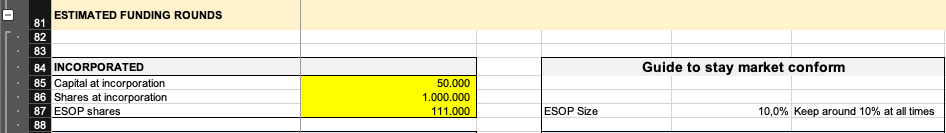

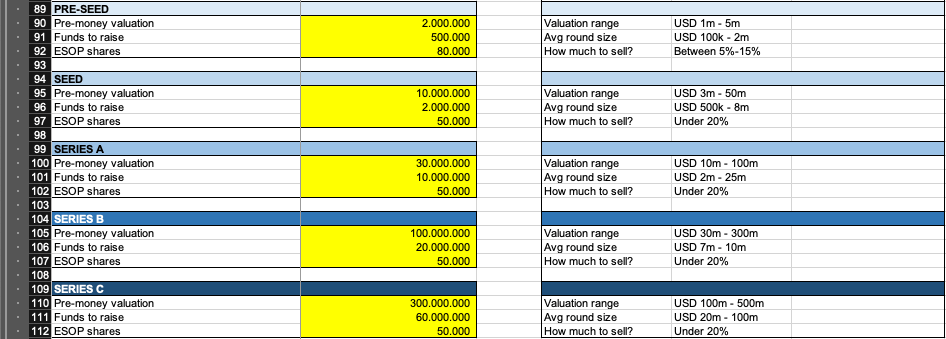

Round sizes

This is the fun part. At this step, you will first need to insert the money injected into the company at incorporation. The number of shares issued and if you have already set up an ESOP then the number of shares that will include. If not then leave it at zero.

The next step is to add the company valuation for the different funding rounds, the money that will be raised, and the number of shares that will be added to the ESOP. On the right side, you will find a guide that will give you an indication of what it usually looks like. But this is just a guideline. It might look completely different for your startup. Depending on what you look up on Google there will be different opinions on the valuation range and round sizes for each round. It also changes based on the market conditions.

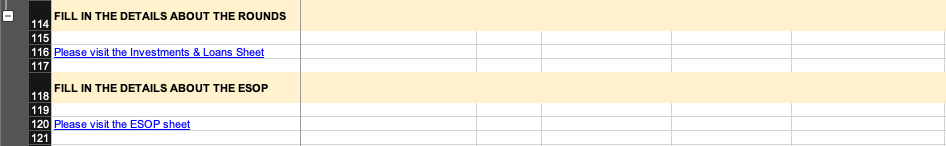

Fill in The Details

Here you will find links to the sheets “Investments & Loans” and “ESOP“.

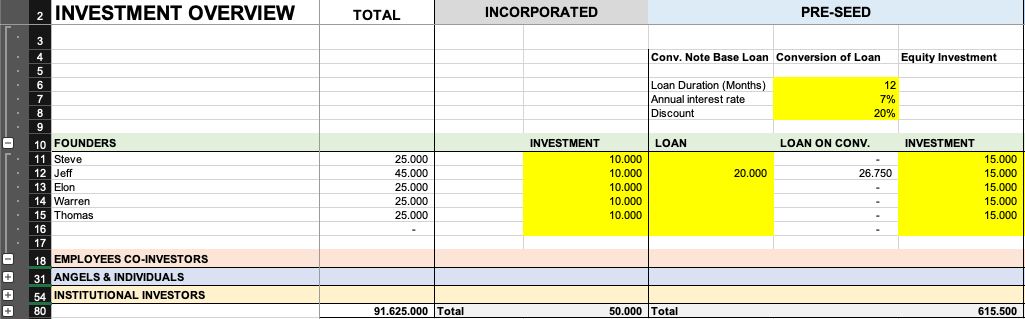

Investments & Loans

In the investments and loans tab you can fill in the details on who has / will be investing/giving convertible notes or loans in the different rounds.

First, you will add the contribution from the co-founders to the incorporation of the company.

Next, you can add the details for the pre-seed round. If the founders or others are giving convertible notes or loans before the pre-seed equity round it will go into the “loan” column marked with YELLOW. You can fill in past rounds as they are and make your best guess for upcoming rounds.

If it’s a convertible not you will have the option to set a duration in months, the annual interest rate, and a discount on the upcoming pre-seed equity round. This will generate an amount that will be used on the conversion. In the investment column, the actual pre-seed investment can be added.

Please notice that you can expand each group by clicking on the + /- on the left side of the application.

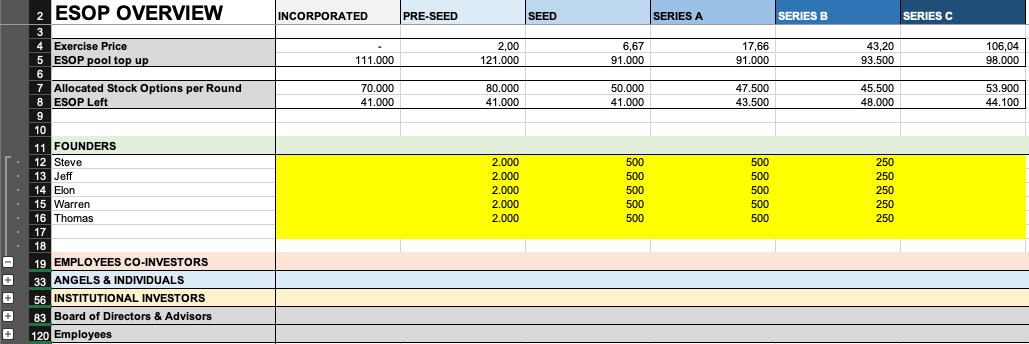

ESOP

In the ESOP (Employee Stock Option Pool) sheet you can make a forecast on who will be granted stock options in the company.

At the top, you will get an overview of the number of stock options present in each round and how many there are left.

You will also be able to add stock options for additional employees, board members, advisors, and more.

If you do not have an ESOP and don’t wish to have one then leave the input fields in this sheet blank.

Please notice that you can expand each group by clicking on the + /- on the left side of the application.

Summary

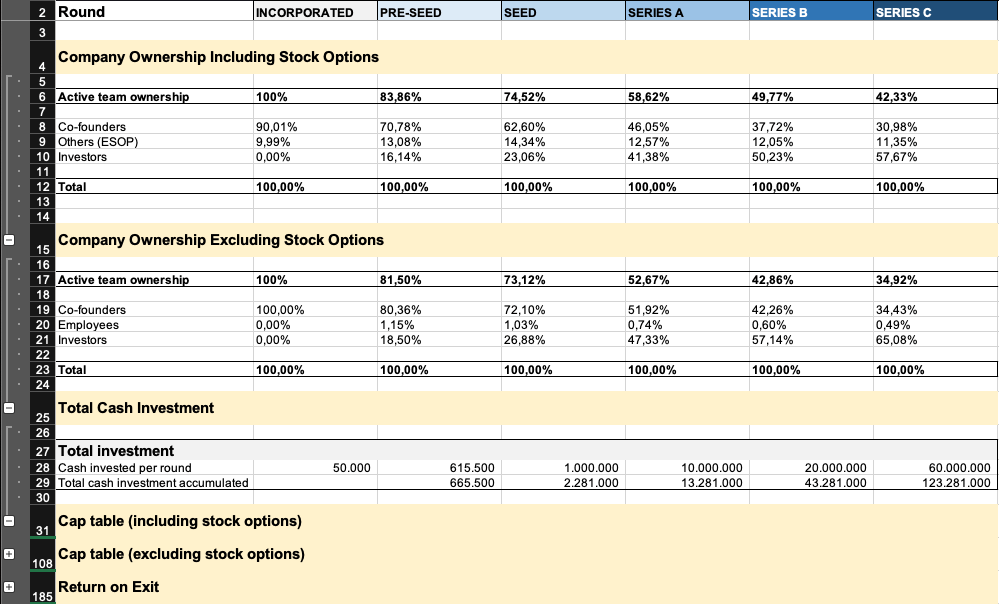

In the summary sheet you will get an overview of the following things:

- Overview of the company ownership including stock options

- Overview of the company ownership excluding stock options

- Total cash investment through funding rounds

- Cap table overview including stock options (expand +/-)

- Cap table overview excluding stock options (expand +/-)

- Return on exit for each owner in the company (expand +/-)

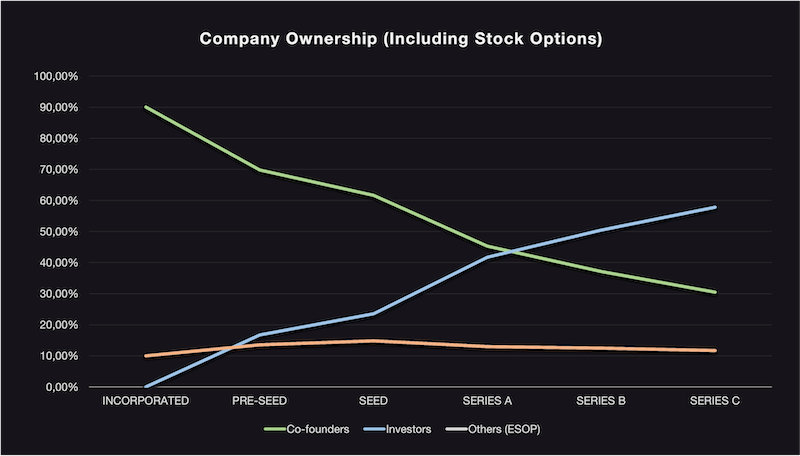

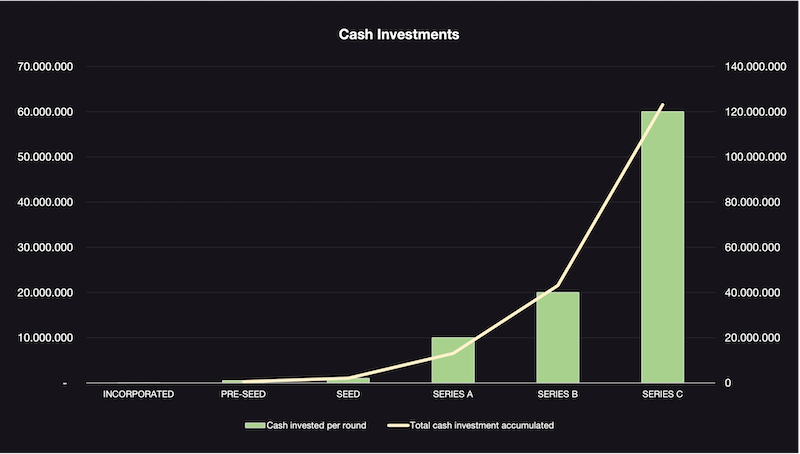

Charts

In the charts sheet you will get a visualization of the summary in 3 different charts:

- Overview of the company ownership including stock options

- Overview of the company ownership excluding stock options

- Total cash investment through funding rounds

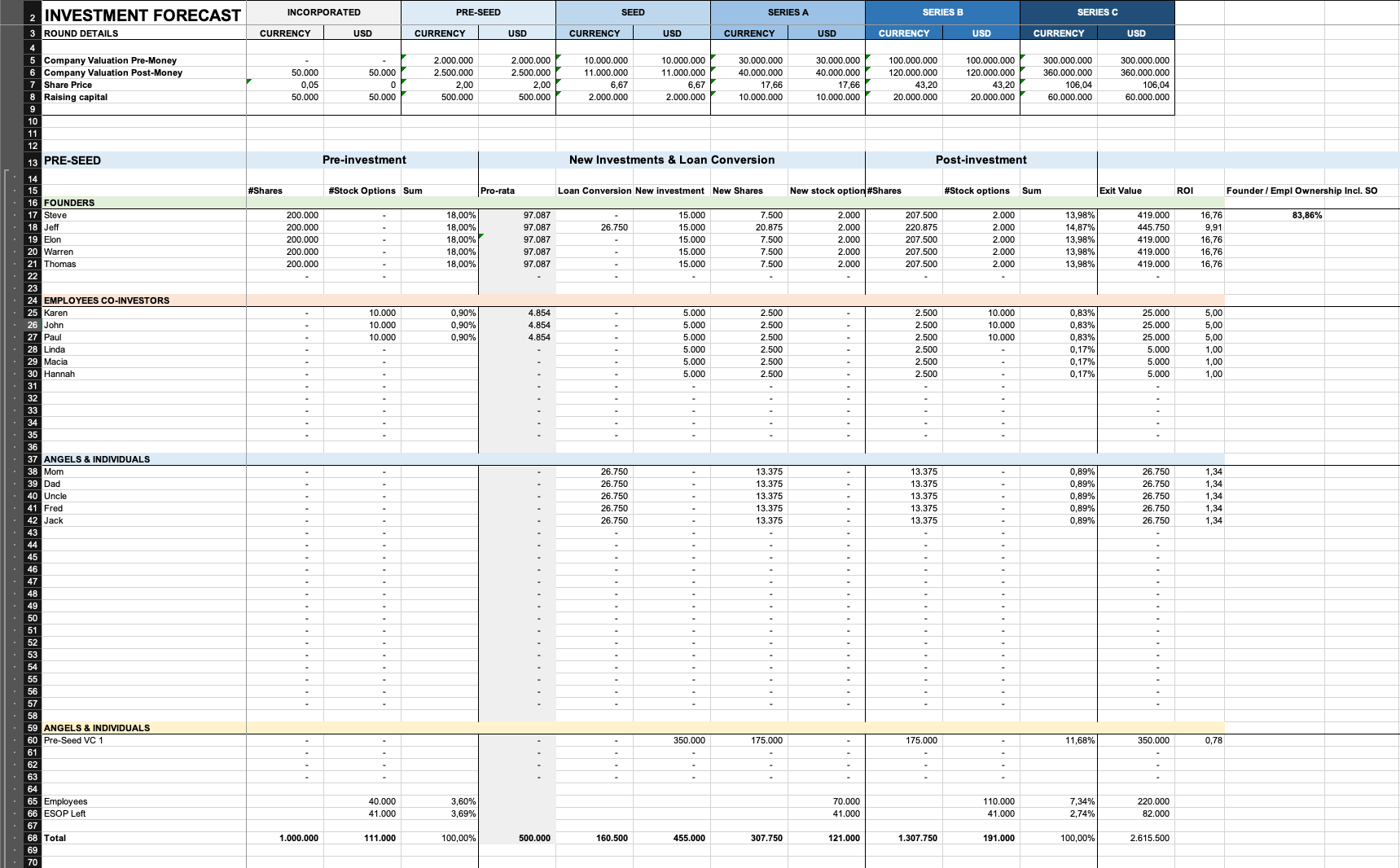

Detailed Investment Forecast

In the detailed investment forecast, you can drill down on the details in each round and get the full overview.

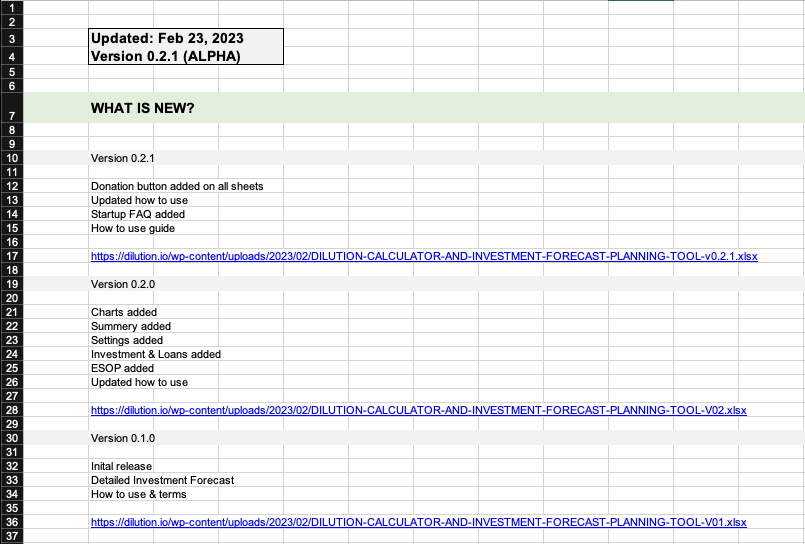

Version History

Here you will get an overview of what has been added in the different versions of the early-stage startup dilution calculator and fundraising forecast tool. In case a more complex migration is needed we will also deliver a guide for that. Here you will also find links to the previous versions of the sheet in case you like that better.

Don’t hesitate to contact us for feature requests that we can add to the backlog.

Purchase The

Startup Dilution Calculator

Version 0.3.0.0

Released Mar 25, 2025

Pricing

-

Global Settings

-

Investment inputs incl. convertible notes

-

ESOP inputs and overview

-

Detailed cap table overview

-

Summerized cap table overview