Plan Your Fundraising Journey

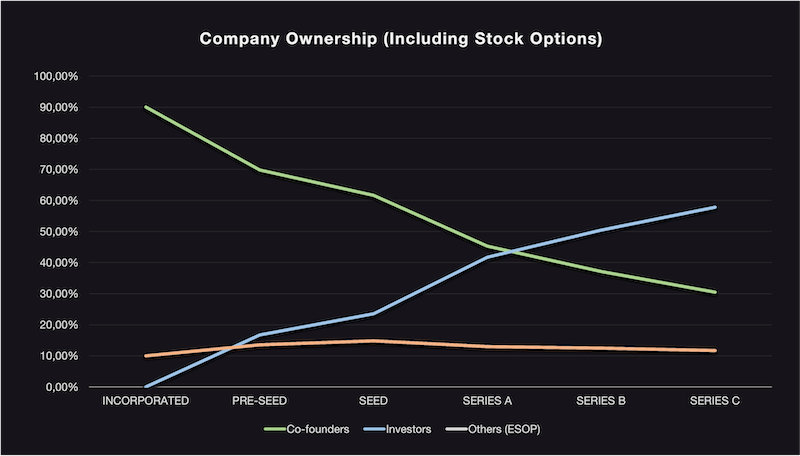

dilution.io provides a share dilution calculator made in excel for startups. It will help startup founders and investors forecast the impact capital will have on the cap table through multiple funding rounds.

Why Planning is Crucial For Startups

Startups require capital to fuel their growth and product development, especially in the early stages when developing the product. However, at this stage there are many uncertainties and assumptions and very limited market reponse. Here’s why planning your fundraising journey is crucial for your fundraising success:

The Importance of External Capital

Founders may initially receive early-stage capital from family and friends or business angels who lack professional tech investment experience. This initial capital may come at a higher cost, and founders may not consider the impact it may have on their company’s ability to raise funds in the future.

Fixing a Broken Cap Table

Fixing a broken cap table is a challenging task. Trust me, I’ve been there. Shareholders may flood the founders with warrants, options, or bonuses until the cap table is back on track. If this approach does not work, your startup may need to relaunch with new investors despite the consequences that will have.

Plan Your Fundraising Journey

Startups should plan their fundraising journey and avoid wasting time fixing their cap table. This dilution calculator and fundraising forecasting tool can help plan your fundraising journey. This proactive approach can help you succeed long term and attract more capital at a better price.

The Dilemma of a Broken Cap Table

How it works

For more information please visit the how to use guide where you will also get an overview of the features inside the sheet.

Share Dilution Calculator

Featrues

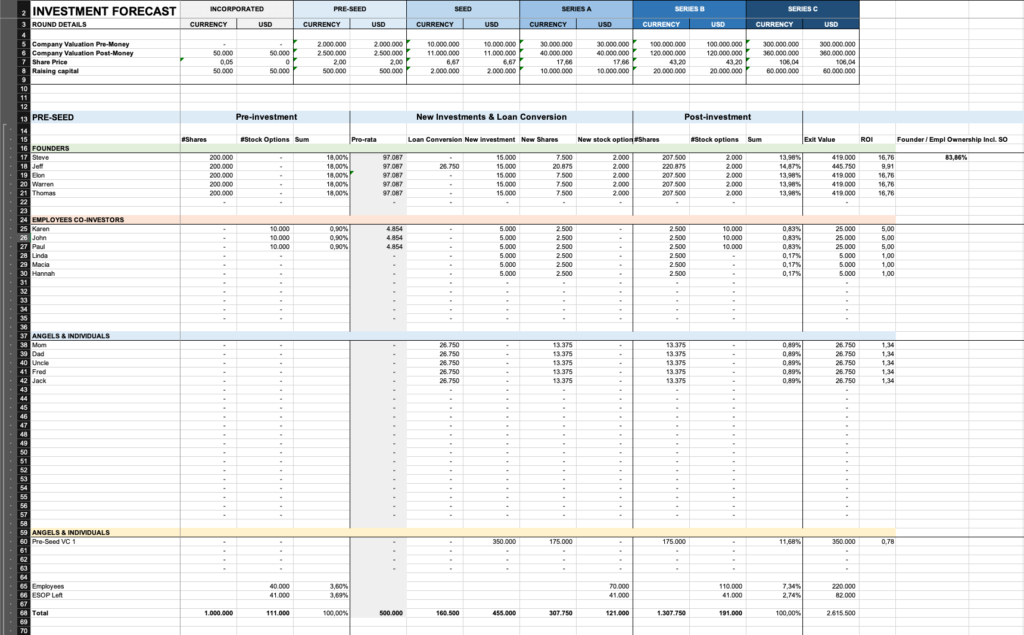

- Forecast the dilution impact on your cap table from multiple investment rounds. From incorporation to Series C.

- Made in Microsoft Excel for easy customization.

- Up to 6 founders, 10 employees, 20 angels & 16 VCs. Hide to rows you don’t need.

- Add an employee stock option pool (ESOP) and top up in each round to maintain a pool of 10%.

- Include convertible notes as pre-round investments and adjust the interest rate and round discount rate.

- Set the pre-money valuation and round size for each round.

- Get a summery overview of the dilution, the cap-table and the potential return on investment for each round.

From A Founder To Founders And Investors

As a founder with 18 years of experience, I have had my fair share of ups and downs with various tech startups. While some of them exited successfully, others unfortunately crashed, and some were closed down.

After consulting other founders, I realized that many of them have been making the same mistakes as I did in the past or were about to do so. Mistakes that potentially can have severe consequences on their startup’s ability to raise funds in the future.

This has led to the creation of this dilution calculator and fundraising planner tool, which will help startups plan their fundraising journey and avoid dilution problems. Problems that can be a huge challenge for even the best startups.

I do not have a background as a VC, banker, or lawyer for that matter. I’m just an average tech founder that has built this for my own use and is now sharing it with the startup community.

Purchase The

Startup Dilution Calculator

Version 0.3.0.0

Released Mar 25, 2025

Pricing

-

Global Settings

-

Investment inputs incl. convertible notes

-

ESOP inputs and overview

-

Detailed cap table overview

-

Summerized cap table overview