Table of Contents

Starting a business is an exciting journey, but it comes with a unique set of challenges. One of the most significant challenges that a startup can face is having a broken cap table. A cap table is a document that outlines the ownership structure of a company, including the number of shares, the percentage of ownership, and the value of each share. If the cap table is broken, it can create significant challenges for a startup, hindering its growth and success. In this blog post, we’ll explore the challenges a startup has if the cap table is broken and how to avoid them.

What is a cap table?

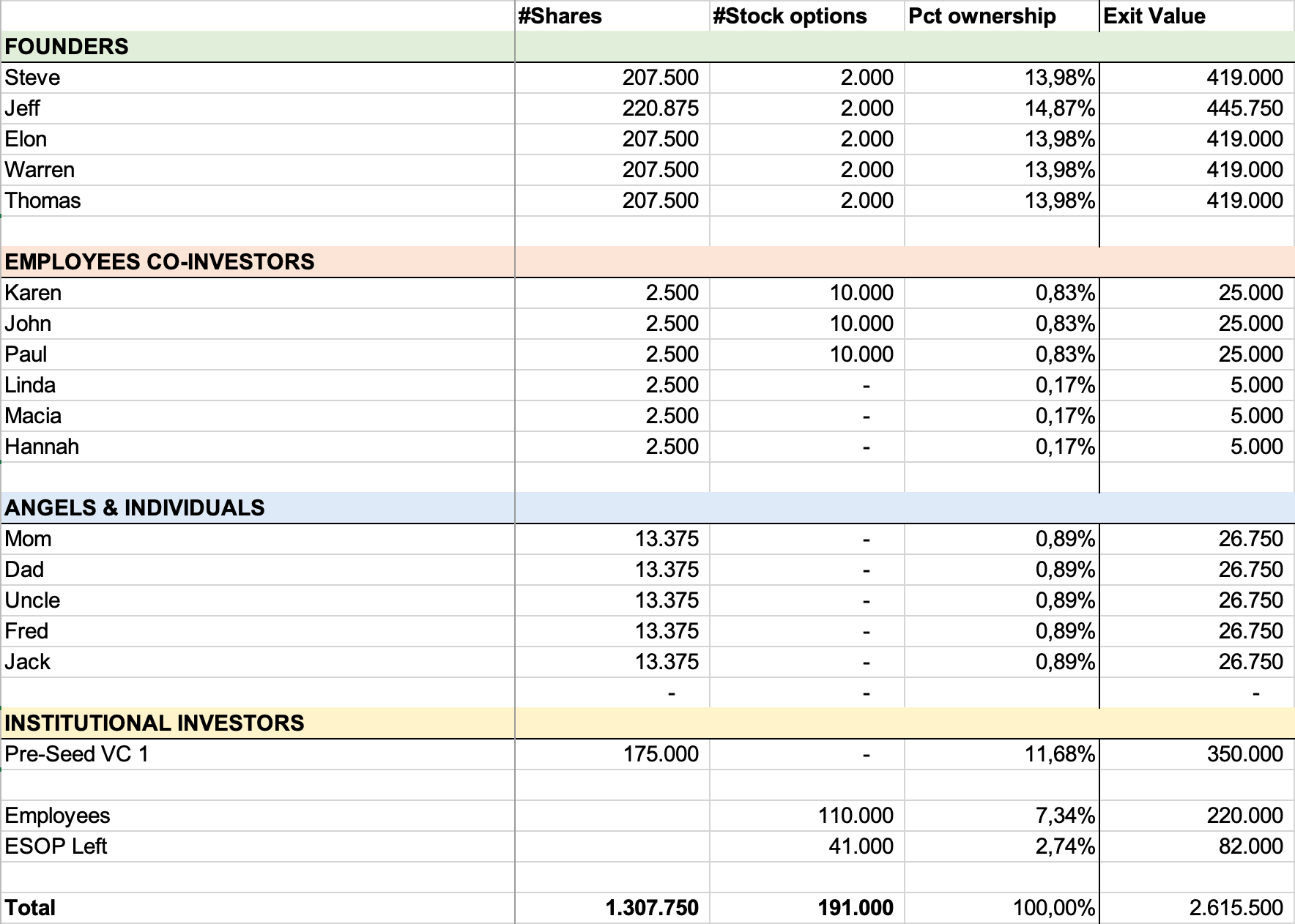

Before we dive into the challenges a startup faces with a broken cap table, let’s first understand what a cap table is. As mentioned earlier, a cap table is a document that outlines the ownership structure of a company. It lists all the shareholders, the number of shares they own, and the value of each share. A cap table is essential for a startup because it helps in fundraising, mergers and acquisitions, and even during IPOs. Usually startups will have their cap table listed in an excel or google spread sheet.

What is a broken cap table?

A broken cap table refers to a cap table that has inaccuracies or discrepancies in the ownership structure of a company or is no longer market conform. A broken cap table can arise due to a variety of reasons, including errors in the documentation, misunderstandings among shareholders, or failure to update the cap table in a timely manner. For startups it often refers to the fact that the founder team has been diluted too much too early and therefore the cap table is no longer market conform. With the knowledge that the startup will likely raise more money in future rounds it’s important for investors to maintain the incentive for the founder team to stay on. With a heavy diluted ownership in the company the chances of losing them during challenging times increases. Therefore, this creates a greater risk for the investment. A broken cap table can create significant challenges for a startup, including difficulty in raising funds, legal complications, difficulty in attracting talent, and a negative impact on valuation. Therefore, it’s essential for startups to maintain accurate, up-to-date and market conform cap tables to avoid any potential problems.

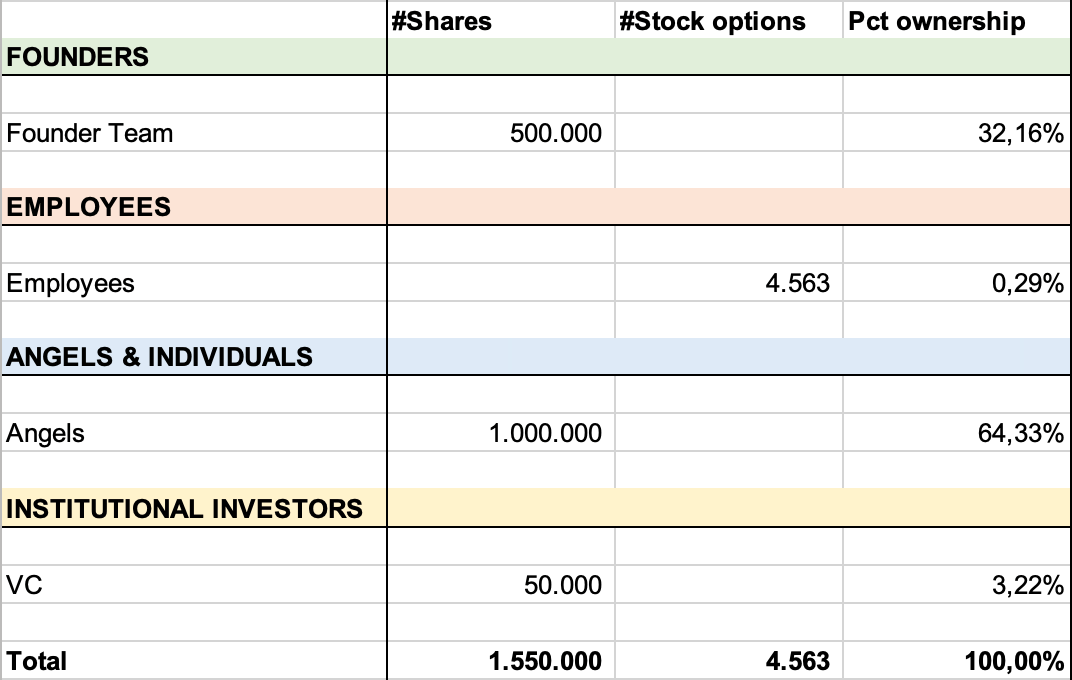

Example of a broken cap-table

The founder team now owns less than 20% of the company before the Seed round. If they are 4 founders that means that they would own less than 5% each.

Challenges if the cap table is broken

Difficulty in raising funds

A broken cap table can make it challenging for a startup to raise funds. Investors usually look at the cap table before investing to see the ownership structure of the company. If the cap table is not in order, or is not market conform, it can raise a red flag for investors. It can lead to a lack of confidence in the management and/or founder team, which can make it challenging for the startup to raise funds.

Legal complications

A broken cap table can lead to legal complications. If there are discrepancies in the ownership structure of the company, it can lead to disputes among shareholders. This can result in litigation, which can be costly and time-consuming for a startup. Legal disputes can also create a negative perception of the company, which can be harmful to its reputation.

Difficulty in attracting talent

A startup with a broken cap table can find it challenging to attract top talent. Talented employees usually look at the ownership structure of the company before joining. If the cap table is not in order or is not market conform, it can create uncertainty and lead to a lack of trust in the management team. This can make it difficult for the startup to attract and retain top talent, which can hinder its growth.

Negative impact on valuation

A broken cap table can have a negative impact on the valuation of the startup. The valuation of a company is based on its ownership structure, financials and potential. If there are discrepancies in the ownership structure, it can lead to a lower valuation of the company. This can make it challenging for the startup to raise funds and can also impact its ability to attract investors.

How to avoid a broken cap table

Keep accurate records

To avoid a broken cap table, it’s essential to keep accurate records. Ensure that all shareholder agreements, option grants, and other ownership documents are up to date and accurate. This will help to avoid any discrepancies in the ownership structure of the company.

Seek professional advice

It’s essential to seek professional advice when setting up the cap table. This can include consulting with lawyers, accountants, and other professionals who can help to ensure that the cap table is set up correctly. Professional advice can help to avoid any legal complications and ensure that the ownership structure is accurate.

Regularly review the cap table

It’s important to regularly review the cap table to ensure that it’s up to date and accurate. This includes reviewing the ownership structure, the number of shares issued, and the value of each share. Regularly reviewing the cap table can help to avoid any discrepancies and ensure that the ownership structure is accurate.

How to fix a broken cap table

Please read this post if you want to learn how to fix a broken cap table or listen to this podcast on Spotify.